David Graeber

The Sword, the Sponge and the Paradox of Performativity

Some Observations on Fate, Luck, Financial Chicanery, and the Limits of Human Knowledge

Abstract

Terms such as ‘fate’ and ‘luck’ are ways of talking about the ambiguities and antinomies of temporal existence that all humans, even social theorists, have to confront in one form or another. Concepts that include mana, s´akti, baraka, and orenda might best be considered as grappling with the exact same paradoxes. Nor should we assume that social scientific approaches are necessarily more sophisticated. Current discourse on ‘performativity’, for instance, seems in certain ways rather crude when compared to the Malagasy concept of hasina (usually trans- lated as ‘sacred power’), which takes on the same dilemma—what I call the ‘paradox of performativity’—in a far more nuanced way.

Keywords

bubbles, fate, luck, Madagascar, magic, performativity, social theorists, technologies

This is an essay about what it means that humans live in history, in a situa- tion where the future cannot be known and the past cannot be changed and, therefore, where the unpredictable is constantly turning into the irreversible. To live this way is simply an aspect of the human condition; it is a situation that everyone has to grapple with in one way or another, including social scientists and the people whom they study.

It is true that social scientists often have a tendency to write as if they have somehow transcended this situation, for instance, describing events that have already occurred as if they could have been predicted beforehand. But when it comes to actually foretelling events, social scientists are rarely much better than anybody else. This creates endless quandaries and dilemmas, and yet every social system has to wrestle with these difficulties in one way or another. In fact, it seems to me that as a result there is a profound—if often unnoticed— structural similarity between many of the more exotic-seeming constructs familiar to anthropology (e.g., mana, s´akti, baraka, magic, fate, witchcraft) and concepts such as luck, chance, and statistical probability, which anthro- pologists employ in their everyday lives, as well as other theoretical constructs that might appear to be the most sophisticated. One reason that this structural similarity is so little noticed, I would argue, is that many of these theoretical constructs have proved remarkably one-dimensional, relying overwhelmingly on one concept—performativity. This effectively reduces almost all forms of human action and thought to politics and, in doing so, has the effect of paper- ing over exactly the most troubling elements of those dilemmas born of the limits of human knowledge. As a result, these constructs are in many ways not nearly as sophisticated as the concepts that we are analyzing.

Obviously, not everything that happens to us comes as a surprise. Much is pre- dictable enough, but what we cannot have is certainty. And even when there is no doubt that an event will definitely occur (we will die, the empire will fall, the bubble will burst), we still cannot be absolutely certain as to when. Indeed, it is the very uncertainty that surrounds events that allows us to classify them as such in the first place. Sunrise is not an ‘event’ because we actually do know precisely when it will happen.

What is really remarkable, though, about the position of social scientists is that they prove to be no better than anyone else at predicting major historical events and, in certain circumstances, are actually considerably worse. Recent history provides a particularly dramatic example: the housing bubble and finan- cial crash of September 2008. It strikes me that we have not yet really taken into account the full implications of academia’s position in relation to what hap- pened in the years leading up to the crash. Granted, economists come off worst of all. It is often remarked that, despite numerous indications of a US housing bubble, virtually no professional economist predicted that the bubble would burst, let alone that the securitization of housing debt premised on economic models that presumed that housing prices would continue to rise forever would lead to global financial meltdown once housing prices did, inevitably, begin to fall. In retrospect, this seems shocking enough. The signs were all there. But the scandal is by no means limited to economists. In many ways, it seems to me, almost everyone in respectable academia, and even many of those who thought of themselves as radicals, appears to have been drawn into what now can only be described as a collection of surprisingly transparent confidence games.

The reason professional economists did not see the bubble is not hard to discern: they were effectively being paid to create and maintain it. To be more precise, many were, like the traders who employed them, directly or indirectly, quite aware that money could not be produced indefinitely simply by saying that it was there, but they had every reason not to point this out to anyone outside the discipline. They were, effectively, enmeshed in a larger political and professional context in which their role was not primarily descriptive but rather performative. Their responsibility was to defend the integrity of existing insti- tutions by arguing that, however prices stood, they were the products of ‘the market’ and therefore, by definition, were accurate indicators of the value of commodities, and that continued investment would thus continue to bear fruit. To make overly pessimistic public pronouncements of any sort was, and still is, referred to as ‘talking down the market’—a fundamental violation of one’s responsibility to the very set of institutional arrangements that guarantee one’s livelihood. To say that the global economy was increasingly founded on a series of shell games would be simply unthinkable.

Some certainly did see it coming and were not afraid to say so. Keynesians like Dean Baker (2002) and sociologist-historians like Immanuel Wallerstein (2003) had been arguing for years that the 1990s tech collapse would inevita- bly be followed by the collapse of the housing bubble and then, finally, that of the dollar bubble, with severe consequences for the US and its position in the world. They were able to do so precisely because they had no professional allegiance to the system. Of course, a cynic would probably remark that just as professional economists have a performative role to play in creating bubbles, in coming up with arguments as to why whatever economic situation prevails at the moment is both morally just and practically sustainable, others—Marxists are an oft-cited example—have an equal and obvious interest in doing the opposite (hence the old joke about the Marxist economist who predicted 17 of the last 3 recessions and three of the last zero terminal crises of capitalism). But this is perhaps just another way of saying that when scholars address themselves to the future, insofar as they are not simply stating the obvious or making random stabs in the dark, they will always, of necessity, be hoping to play some role in shaping the object of their ostensible analysis. Particularly in the case of economists, it is hard to imagine that it could be any other way.

On Theoretical Bubbles and the Paradox of Performativity

The notion that economists play a performative role in creating the markets that they claim to describe is nothing new. In fact, ever since Michel Callon’s (1998) announcement to this effect, the ‘performativity of economics’ has been some- thing of a theoretical boom industry (see, e.g., Aitken 2007; Holm 2003; MacK- enzie 2004; MacKenzie, Muniesa, and Siu 2007; Miller 2002). So it is not that scholars were unaware of the existence of such performative gestures. It is more that they had become so attached to them, and so in awe of their power, that they could no longer imagine any limits to them. This remained true as high finance began to become a world of collateralized debt obligations and credit default swaps, one that saw the emergence of a global ‘shadow economy’ of some $12 trillion based on manipulating money that had been essentially whisked into existence by saying that it was there and where speculation increasingly came to mean taking bets on how long it would take for investors to figure out that it really was not there. It was a world in which performative gestures were becoming increasingly indistinguishable from what the more traditional popular economic parlance refers to as ‘scams’. A bubble is, after all, by definition a situation in which a certain type of commodity (land, stocks, tulips, petroleum) becomes wildly overvalued as a consequence of speculation. Economists at least recognized the possibility of speculative bubbles, even if they usually felt a pro- fessional responsibility not to identify them while they were happening.

Increasingly, during the period of roughly 1980–2008, social theorists came to embrace the notion of performativity so completely that the very idea of a bubble came to seem a contradiction in terms. After all, if value is simply a performance, if it is just whatever people think it is, then obviously there can be no bubbles, since there is no basis on which one can say that a certain stock or plot of land is overvalued. By this logic, if bubbles do burst, it can only be because economic actors do not accept that this is the case, all the while stubbornly insisting that ‘market fundamentals’ and even a ‘real economy’ actually do exist.[1]

The period in question corresponds to that of the financialization of world capitalism, when the amount of money placed globally in speculative markets quickly came to dwarf that invested in trade and industry, and when almost everyone in wealthy countries was encouraged to invest in the resulting specu- lative markets in one form or another. It might be a bit early to write the his- tory, but in retrospect, it seems to me that what is really striking about this period is the degree to which the effectiveness of such performative gestures came to be seen not just as the basis of the economy but also as the central principle of politics and even of our understanding of the nature of social life. Consider first politics. The period of the great American housing bubble also corresponded to the presidency of George W. Bush,[2] a man whose staff, steeped as they were in a culture of religious faith, would sometimes openly admit that they considered ‘reality’ to be simply whatever people could be made to believe—that is, that there was ultimately nothing beyond what can be assembled and held in place through techniques of political persuasion (if also backed up by the threat of physical force). The notorious explanation of one unnamed Bush aide was recounted by New York Times writer Ron Suskind (2004: 15): “The aide said that guys like me were ‘in what we call the reality- based community,’ which he defined as people who ‘believe that solutions emerge from your judicious study of discernible reality.’ … ‘That’s not the way the world really works anymore,’ he continued. ‘We’re an empire now, and when we act, we create our own reality.’”

There is a fascinating parallelism here between, on the one hand, the belief of conservative Republican Christians that power creates its own truths and its own realities and, on the other, the pervasive Foucauldianism of the American academe of recent decades, not to mention the great burst of theoretical interest in the notion of ‘performance’ that accompanied it. No doubt, the phenomenon will attract a lively interest among future intellectual historians. The widespread assumption that no meaningful distinction could be made between the nature of reality (even scientific reality), the techniques of knowledge designed to analyze and interpret that reality, and the forms of institutional power within which knowledge is produced ensured that when social theorists did turn to economic matters, they would see things in the same light. Callon might have been the first to emphasize—and celebrate—the performative role that economists play in creating markets, but by the height of the boom, many were going much further than he ever dared. I well remember attending conferences in 2006 and 2007, just before the great crash, at which cutting-edge social theorists (I will be kind and not mention any names) presented papers describing some of the complex financial derivatives that had come to dominate the airy heights of global financial markets during those years, arguing that these new forms of securitization, linked to new information technologies and new modes of think- ing about physics and biology, heralded a looming transformation of the very nature of time and possibility—of the very structure of reality itself.

We might chalk this up to one embarrassing case of gullibility. At the time, the line within the industry was that the mathematical formulae behind these new forms of securitization were so complex that only astrophysicists could pos- sibly understand them, and many academics seem to have fallen for the ruse, hook, line, and sinker. (Some of the astrophysicists in question, incidentally, have since admitted that they did not understand the algorithms either; really, they were just making things up.) However, the answer to the question, what laid them open to such naiveté? goes deeper. The age of the financial bubble corresponded to a kind of high watermark of the political. The logic of politics invaded and began to colonize everything, from economic life to social theory, to the point that it often seemed to be the only possible principle of social life— of reality, even. Actor-Network Theory (ANT), as developed by Bruno Latour and by Callon himself, could in fact be seen as the ultimate apotheosis of this tendency. What it did was to take the principle of political persuasion, represen- tation, and alliance building and treat it as if it were the ultimate principle of ontology. For ANT, reality itself, even down to the microbial level, is simply that which can be negotiated between the relevant actants.[3] This is why no one was prepared for the meltdown. How could it all be a scam? A scam, after all, is a deceit, a misrepresentation—and in politics there is only representation.

I should be more explicit about what I mean by ‘politics’ here. If a phrase like ‘the political’ is to mean anything, I would argue, it can refer only to that domain of human action and experience where reality actually is whatever one can convince others to accept. This is precisely what makes it different from other spheres of human activity. After all, if I were to convince everyone in the world that I could fly and then jumped off a cliff, their confidence in my abili- ties would make no difference: I would still plummet to my death. If I were to convince everyone in the world that I was Emperor of Argentina, on the other hand, I would indeed be Emperor of Argentina. Politics, then, is the domain of the performative, but therein lies its central dilemma, its fundamental para- dox—that is, to conduct politics effectively, one cannot admit this. I cannot very well convince the world that I am Emperor of Argentina by telling everyone that if they believe this, it will become true. To play the game of politics, one must constantly insist that there is something else, something more real, lying behind one’s claims. What that is does not much matter and can vary almost infinitely, from divine grace to popular will, national destiny, the right of conquest, or the inevitable unfolding of some historical dialectic. What matters is that it is not seen as sheer performativity. As a result, politics everywhere has always been surrounded by a certain air of buncombe, hypocrisy, and lies.

Let us call this the ‘paradox of performativity’. There is a striking similar- ity between this notion and anthropological theories of magic, particularly the strain that sees magic as essentially a form of expressive performance—a strain that runs through Malinowski (1922, 1935, 1948]), Leach (1954, 1982), and Tambiah (1985; cf. Graeber 2001: 256–260).[4] Insofar as it is a form of per- formance, magic—like politics—is also about making something true by say- ing so, and this is one reason that it, too, is widely seen as lingering halfway between poetic expression and outright fraud.

Relativistic anthropologists have always been uncertain about how to approach the fraud element. There has been a bit of uncomfortable casting about when they have to confront the fact that, even among the Kwakiutl or Azande, most audience members witnessing magical performances assume that the performer is likely to be an imposter and confidence artist. But this is, of course, because most Kwakiutl or Azande are not relativists themselves. In a similar way, recent attempts to refound reality on political principles—power, performance, negotiation—seem to fall into a comparable relativist trap. They ignore what is perhaps the most important dimension of politics itself. Actu- ally, one could well argue that they ignore the two most important dimensions of politics because, unlike the anonymous Bush aide who had no trouble admitting “we’re an empire now,” performance theorists regularly sidestep the whole question concerning those relations—what we euphemistically refer to as ‘force’—that hold it all in place. The difference between the shaman and the economist, after all, is that the shaman is relying only on performance; mar- kets, in contrast, are held together by property rights backed up by the power of armies, judges, prisons, and police. The role of governments (and weapons) becomes even more apparent if we turn—as, again, Callon and his followers often seem determined to avoid doing—to the role of money.[5]

If it is one of the secret scandals of capitalism that its core institutions have always been entangled in government, nowhere is this truer than in the case of money. Capitalist money per se has always been primarily government debt money, usually created through central banks, that is, chartered monopolies that are given the right to issue government debt in the form of paper money. The Bank of England is the paradigmatic example. It was created in 1694 when a consortium of 40 London and Edinburgh merchants offered King William III a £1.2 million loan to help finance a war against France. In doing so, they also convinced him to allow them to form a corporation with a monopoly on the issuance of bank notes, which were, in effect, promissory notes for the money that the king now owed them. This was the first independent national central bank. It became the clearing-house for debts owed between smaller banks, and the notes soon developed into the first European national paper currency. However, not unlike much earlier Dutch or Venetian bonds, German rentes, or Spanish juros, this paper money was essentially negotiable government war debt. In other words, in a gesture of what can only be described as magnificent circularity, the value of money was ultimately that of a promise to repay made by a government that had taken out a loan to enable it to create and main- tain the very apparatus of violence (not to mention the underlying property relations and institutional structure) that guaranteed its ability to repay the loan to begin with.

This circularity was not lost on contemporary observers, who were aware that capitalist finance was ultimately based on public credit.[6] In 1711, the satirical essayist Joseph Addison penned a little fantasy about the Bank of England’s—and, as a result, the British monetary system’s—dependence on public faith in the legitimacy of the king’s title and the political stability of the throne (the Act of Settlement of 1701 was the bill that guaranteed the royal suc- cession, and a sponge was a popular symbol for default):

He saw Public Credit, set on her throne in the Grocer’s Hall, the Great Charter over her head, the Act of Settlement full in her view. Her touch turned every- thing to gold. Behind her seat, bags filled with coin were piled up to the ceil- ing. On her right the door flies open. The Pretender rushes in, a sponge in one hand, and in the other a sword, which he shakes at the Act of Settlement. The beautiful Queen sinks down fainting. The spell by which she has turned all things around her into treasure is broken. The money bags shrink like pricked bladders. The piles of gold pieces are turned into bundles of rags or faggots of wooden tallies.[7]

Not only is the money system dependent on public faith, but that fact opens it up to every sort of confidence game and manipulation. It is no coincidence that while the Bank of England and Bank of Scotland did manage to establish themselves on a permanent basis, similar early efforts in Sweden and France were spectacular failures. The Bank of England itself barely withstood the crisis of the South Sea Bubble of 1720, nine years after Addison’s essay appeared. The creation of a government-sponsored joint stock operation, supposedly aimed to harvest the wealth of South America, turned into a veritable orgy of what would now be called start-up offerings. Joint-stock corporations floated shares that in every case were bid to outrageously inflated prices by investors determined to cash in on the bubbles that they knew they were creating before the bubbles inevitably burst. “Every fool,” as one popular ballad of the time aptly put it, “aspired to be a knave,” that is, to get in on the game of creating value out of nothing and then, even more importantly, to get out before the money bags shrank like pricked bladders, leaving some other sucker with the resulting bundle of rags.

The danger of such speculation was one of the main reasons for the cre- ation of central banks to begin with, yet the resultant permanent entanglement of government and capital hardly purges money of its political—and thus magical—element. Ever since Goethe had Faust, working with his assistant Mephistopheles, save the German emperor from his debts by convincing him to invent paper money (to be based, he explained, on the value of gold as yet undiscovered beneath the surface of his empire), there has been a sense that there is something vaguely diabolical about the idea of a money system based purely on government promises, if only due to the tacit recognition that— liberal protests to the contrary—‘financial wizardry’ is never too far removed from the business of equipping armies and police.

Chance

The best thing that can be said about the current theoretical emphasis on per- formativity, I think, is that it never allows us to forget that social constructs— whether markets, genders, or scientific theories—do need to be constructed; they do not simply exist but have to be constantly produced and, even more, maintained by human action. This is a welcome break with past approaches that often took such constructs completely for granted. Their central flaw was that they overlooked the fact that those who create and maintain such con- structs cannot themselves rely on a theory of performativity.

So what popular concepts did emerge during this same period of the rise of modern money and financial capitalism? The answer is well-known. It was no coincidence that contemporary concepts of luck, chance, probability, and risk also emerged at the end of the seventeenth century and developed in close association with both modern, popular gambling (Reith 1999), modern statistical science, and the familiar apparatus of finance, that is, stocks, bonds, commodity futures, put options, brokerage houses, and, eventually, the science of economics itself (see, e.g., Beck 1992, 1999; Hacking 1975, 1990). These concepts have come to seem so commonsensical to those raised in worlds dominated by such institutions that we tend to forget how peculiar their basis really is. I remember how startled I was, when I first began my studies in Mad- agascar, to discover that even well-educated urbanites, fluent in French or even English, simply had no idea what I was talking about when I alluded to them. A typical conversation with a friend (conducted, in fact, in English) follows:

David: What do you think the chance is that a bus will come in the next five minutes?

Zaka: Huh?

David: I was thinking of running up the hill to get some cigarettes. I figure it’ll take maybe five minutes. What do you think the chance is that a bus will come before I’m back?

Zaka: I don’t know. A bus might come. David: But is it likely to?

Zaka: What do you mean?

David: You know, what’s the chance? Is there a very large chance it will come? Or just a small chance?

Zaka: A chance can be big or small?

David: Well, is it more like 1 in 10? Or more like 50–50?

Zaka: How would I know? I don’t know when the bus is going to arrive.

No doubt, if I had investigated the Malagasy terminology employed by poker players and other gamblers, who were legion, I would have been able to find a vocabulary that could be used for such purposes. But the fact remains that this language was not commonly employed for everyday situations and these concepts did not come intuitively. Even when my Malagasy did become fluent,

I never heard people employing language in the way that people would do so in America, for example, “I’d say 3 to 1 the cops won’t even notice that I’m parked here.” In fact, I discovered not only that such a way of thinking was unknown to most Malagasy, but also that, once explained, it seemed just as peculiar, exotic, and ultimately unfathomable as any of those classic anthropo- logical concepts, such as mana, baraka, or s´akti, regularly employed in other parts of the world to put a name on the play of chance or to explain otherwise inexplicable conjunctures or events.

Once I began to think about it, I realized that this puzzlement was a pretty reasonable response. Chance actually is a very peculiar concept. Zaka was right: the main thing is that we do not know when the bus is going to arrive. This is the only thing that we can say for certain. Anything could happen—the bus might break down, there might be a strike, an earthquake might hit the city. Of course, all these things are, from a statistical perspective, very unlikely, million-to-one chances, really. But it is that very application of numbers to the unknowable that struck my Malagasy interlocutors as bizarre—and not without reason. What a statistical perspective proposes is that we can make a precise quantification based on our lack of knowledge, that is, we can specify the precise degree to which we do not know what is going to happen.

In places where such concepts are still relatively new (at least to many), there are jokes about this sort of thing. Following is a story from 1980s Lebanon during the civil war:

There was a Lebanese executive who used to make regular business trips in and out of the Beirut airport. Once, after a late night drinking with friends, he admit- ted that every time he flew out of the city he brought two briefcases with him: one for his papers, the other full of plastic explosives.

“But Hassan,” exclaimed one of his friends, “you’re the last person in the world who’d ever be a terrorist. Why would you want to blow up an airplane?”

“I wouldn’t. Actually I’m terrified of the very idea of it.” “Then why bring a bomb?”

“As a security precaution. I mean, think about it statistically. What’s the sta- tistical chance there would be two different bombs on the same airplane?”

The intrinsic oddness of statistical thought is all the more striking when one considers that the resultant concept of risk has become central to the very essence of our current profit-based economic system. Profit, after all, is almost universally looked on as an entrepreneur’s reward for being willing to under- take risk. This was an idea originally set down in print by the economist Fred- erick Hawley (1893), but already a generation later it was being described as economic common sense by entrepreneurs themselves (Hopkins 1933; Knight [1921] 1957: 362). While the history of such ideas needs to be reconstructed in greater detail, we seem to be in the presence of a curious transformation of aristocratic honor, which was all about the willingness to wager everything— first in war, later at the gambling table—into a kind of inverted bourgeois form. Insurance and other such financial innovations were initially created to minimize the very sort of risk that was an aristocrat’s greatest glory, but in this transformation, risk, now reframed as an onerous burden that no one would wish to undertake for its own sake, returned as the very thing that the entre- preneur was to be rewarded for being heroically willing to undertake. In the process, the very notion of risk showed a remarkable tendency to constantly explode its boundaries. Already in the 1920s, Knight was challenging Hawley’s idea of calculated risk by arguing that profit is based not in the calculation of odds but in making oneself open to absolute uncertainty, to the fact that war, famine, or utterly unpredictable turns of the market—history, as I have called it—might derail any economic project at any time. Profit was the capitalists’ reward for having the courage to enter history.

More on Time and the Human Condition

Let me return from the magic of the marketplace to more familiar anthropologi- cal ideas of magic. I began this essay by saying that whenever one encounters apparently murky, mystical concepts of invisible power like mana—which Mauss and Hubert (1904) so famously saw as the basis of magic—or even concepts such as fate or witchcraft, one is normally dealing with fundamental dilemmas in the human situation, problems that no one, including social theo- rists, fully understands or ever will.

Aristotle wrote in his Poetics that a good story is one in which everything that happens surprises us when it happens, but afterward seems like the only thing that could possibly have happened. This is just a way of saying that art should imitate life because this is almost precisely how we experience the course of events, at least over the long term. We have no idea, really, what will happen in the future. We can imagine all sorts of possibilities, at least in what some like to refer to as ‘aleatory’ points in human affairs (using a word derived from the Latin for ‘dice’, with life literally becoming a crapshoot). But in fact only one thing will happen: our father will recover from pneumonia or he will not; our daughter will win the scholarship or she will not. And as soon as we discover which one thing that was, to say that something else ‘could’ have hap- pened rapidly becomes pointless, even meaningless.

Historians, who have to deal with this sort of problem head-on, deliberate about determinism versus voluntarism: To what extent are humans really actors in history? To what degree are outcomes predetermined? The fascinating thing is that there is no possibility of providing evidence for either position: the question is ultimately just a matter of philosophical taste. Since at any aleatory moment only one thing does in fact end up happening, it is not entirely clear what say- ing that something else could have happened would even mean. One cannot go back to 1769, strangle Napoleon in his cradle, and then observe how differently history would have turned out. As a result, writing about what might have hap- pened becomes, at best, a parlor game. This becomes all the more true the more that time goes on. Alfred Toynbee (1969), for instance, wrote an essay titled “If Alexander the Great Had Lived On” in which he speculated about what might have happened had Alexander taken his doctor’s advice and not died young of fever (for the curious reader, he ends up conquering India and China, while his successors convert to Buddhism, invent the steam engine, and, after a couple generations, discover America). It is my impression that most historians con- sider this essay something of an embarrassment. Certainly, it is hard to imagine any lesser figure being allowed to get away with publishing such an effusion in a historical journal, rather than as a work of fiction. But even the question, could Hannibal have won the Second Punic War? is problematic in the same way. For that matter, so are commonplace thought experiments, such as, what would you have done if you were Napoleon in 1812? After all, if one were Napo- leon, would one not have done exactly what Napoleon did?

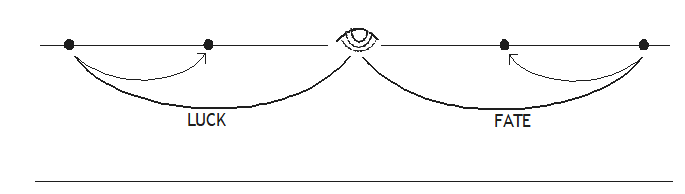

To make a case that notions such as fate, luck, chance, or probability, and also ones like mana, grace, or witchcraft, are all ways of grappling with this fundamental paradox—that while we cannot foresee the future, once that future has become the past, it is almost impossible to look on what happened as something that should not have been foreseeable—would be an elaborate proj- ect. But it is easy, I think, to see how such a case could be made. The concepts of fate and luck are particularly straightforward. Imagine a simple timeline, as shown in figure 1.

Fate might best be considered as a matter of seeing the future from an imaginary point in time even further in the future, when that future will have become the past. From the perspective of the present, there are a million differ- ent things that might happen tomorrow. From the perspective of next month or next year, there was only one thing that did happen—it is just that we did not know beforehand what that one thing was. This is similar to destiny, which is a matter of ends. At some point in the future, we will look at our lives or current events as a story. Stories, by definition, end. Destiny is that currently unknowable future point that people even further in the future will construct as the end. And if this is the case, luck is a simple inversion, a mere matter of flipping the chart around.

Luck is (first and foremost, anyway) seeing the past from a point even further in the past when it was still the future. When one says, “That was just a stroke of dumb luck,” one means that one would have had no way to predict before- hand that such a thing would happen. This is the foundational structure of the notion of luck: it is, as we all know, transposable. We can talk about hoping that our luck will hold out or change, or that we will get lucky. Even so, this is true only within reason. To push luck too far into the past quickly becomes pointless. Was Rome just lucky that Hannibal got so little support from the Carthaginian senate? Again, it can only be a meaningless question.[8]

Endless further subtleties could be introduced, yet the critical thing is that we are dealing here not with fundamentally different concepts but rather with pivoting perspectives along the same temporal continuum—one where our absolute inability to predict what the moving finger is about to write beforehand is matched only by the absoluteness of our inability to cancel half a line of it afterward. This does have some interesting implications. For one thing, it sug- gests that what we like to call ‘fatalism’—the assumption that all outcomes are already fixed—is simply a matter of looking at everything from the perspective of the future (millennial or otherwise) or, alternatively, to add another dimen- sion, from some divine perspective outside time entirely, which in effect comes down to the same thing.

It also helps to explain why—generations of missionaries and Orientalists notwithstanding—a mere tendency to advance notions like fate or destiny does not actually lead people to fatalistic passivity. In fact, it rarely even results in the belief that destinies are unalterable. Often, we find that the very people who most consistently evoke the notions of fate or destiny have the most elaborate technologies designed to alter them.

Here it is telling to return to Madagascar for a moment. I found that even my educated urban friends, when speaking their own language at home, would make use of the traditional Malagasy concepts that missionaries (e.g., Dahle 1876, 1886–1888) have cited in the past—and sometimes still cite (e.g., Molet 1979)—to argue that traditional Malagasy are mired in a fatalistic inabil- ity to take control of their lives. If one considers how these words are actually employed, however, and especially if one examines the forms of practice in which they appear to have taken shape, it becomes obvious not only that nothing could be further from the truth, but also that these ideas have crys- tallized around precisely the paradoxes that I have been setting out over the course of this essay.

Take, for example, hasina, which is the closest one can come to a Malagasy word for luck. If one wants to explain, say, why two fishermen with identical gear and experience can head out on the same day, and one comes home with a bountiful catch and the other with nothing, then hasina can be the only expla- nation. However, hasina is usually spoken of as if it were vested in persons and objects, which has caused many observers to describe it as something akin to mana. Alternatively, and perhaps more accurately, it has been described as “that invisible quality that can produce visible results” (Délivré 1974: 144–145; my translation). As such, it is also used for persuasive words and, above all, for the power that lies behind everything—beads, stones, the tombs of ancient kings— that we usually refer to as ‘magic’ or even ‘sacred’. Still, insofar as hasina is lodged in any of these things, it has to be maintained, most often by conducting rituals, observing taboos, or, at the very least, by being acknowledged and rec- ognized. It is often said that by doing so one creates hasina to begin with.

What is more, when I discussed such issues in the abstract—and I found this to be true of pretty much everyone who cared to venture an opinion on these matters, notwithstanding their level of formal education—my inter- locutors almost always fell back on some variation of what I have called the paradox of performativity. If someone is directing a charm against you—love medicine, for example, or something intended to make you ill or drive you insane—it can work only if you know about it and if you actually believe that it will work. This, I was often assured, is why I was safe: such devices never work on foreigners. At the same time, assurances like these were completely contradicted by actual practice, since people would regularly consult with cur- ers to see if their illness, bad luck, or other misfortunes were actually caused by some magical charm that they might not be aware of. The situation would lead to endless quandaries. “Ever since I moved to this village,” one urban- educated young man told me, “people have been trying to ensorcel me. Of course, it doesn’t work because I don’t believe in any of that nonsense.” “Yes,” said his sister, resignedly. “I thought I didn’t believe in it either. But I guess I must believe in it because I keep getting sick all the time!”

In our terms, then, the concept of hasina is quite remarkable in that it rolls into one notion the two great paradoxes that we have been discussing—that is, the paradox of performativity (that some things do become true just because you can make people believe them, but that you cannot make them believe them if they believe this to be true) and the paradox of fortune (that those things we cannot predict in the immediate future will seem inevitable after they have occurred). The result is, obviously and necessarily, unstable, and hasina vibrates with internal contradiction. But this is the very essence of its power.

In contrast, consider the term vintana, which is usually translated as ‘des- tiny’. While hasina is about everything that cannot be pinned down, vintana is the very opposite. It is dense with specificity. Technically, there are 12 named vintana, which are based on the 12 lunar months of the Arabic calendar. The system is also superimposed on space: the northeast corner of one’s house, for instance, corresponds to Alahamady, the first month of the year, the southeast to the fourth month, the southwest to the eighth month, and so on. Finally, the system is fractal, so that not only each year but also each month, day, hour, and minute could, in principle, be divided up according to the same 12-part system. In essence, everything is determined by complex numerological cycles, and just as the exact date and time of one’s birth determined one’s character and the events of one’s life, so did the moment at which one began any major undertaking—building a house, starting out on a journey, running a military campaign, setting up a business enterprise—determine its eventual outcome.

There is already a very specific principle here—that all things have a begin- ning and an end, and that the quality of the one in some sense determines the quality of the other. To return to the principle of narrative, the problem is that there is no rule to establish the actual beginning and end of most real-world phenomena. Indeed, many Malagasy rituals could be interpreted as a means to establish some sort of socially agreed-upon narrative framework to resolve precisely this problem. One of the most spectacular examples is the practice of collective ordeals, when everyone in a community prays to the ancestors to strike down whoever committed some great crime, so that everyone can agree that the person next to die must have been the guilty party. This logic could be compared with some of the arguments currently being developed by scien- tists about the nature of ‘open systems’. Even if direct, predictable cause-effect outcomes can be produced in laboratory experiments, in which action A is always followed by effect B, so many different kinds of causative mechanisms are operating simultaneously in the real world that prediction must necessar- ily slide back into probability and guesswork. The usual example given is our inability to predict the weather, and it is probably no coincidence that andro, the word usually used in colloquial Malagasy to substitute for vintana (a word that in common parlance has a more old-fashioned, formal color), literally means either ‘day’ or ‘weather’.

Finally—and this is the really crucial thing here—no one really reflects much on destiny as an abstract concept. You will occasionally find people reflecting on the nature of hasina. But if destiny comes up, it is because there is some prac- tical problem that needs to be addressed—that is, because there is something that can be done to alter it. Rural elders would almost always claim a certain knowledge of astrology, which, they insisted, informed important decisions about where to place houses or tombs or when to begin planting or harvesting. There were professional astrologers, called mpanandro, whose basic work was referred to, in turn, as a matter of ‘constructing’, ‘adjusting’, or ‘repairing’ des- tinies (manamboatra vintana), largely through the use of medicines and charms and the arrangement of architectural space. This could be done for any reason, for example, to counsel a married couple with clashing dispositions (due to their natal destinies) so that they could live harmoniously, to help a client pass a bac- calaureate examination, or literally to manipulate the weather, say, by sending a rainstorm to ruin a ceremony sponsored by a rival astrologer.

This of course raises another question, also familiar from debates within the philosophy of science—that is, can human understanding of, and interven- tion in, a complex system of determinations itself be considered a product of that system, or should it be treated as an emergent level standing outside of it? Among those I knew in Madagascar, almost everyone seemed, on the surface, to be committed to the former explanation: astrologers regularly insisted that their own knowledge came not so much from study but spontaneously, owing to their own peculiar andro. However, what this knowledge came down to in practice was the ability to step outside any system of determinations entirely. Greek tragedy is full of stories about heroes who consult soothsayers and ora- cles in an attempt to escape their destiny, only to set in motion the very chain of events that they were so desperately trying to avoid (Sophocles’ Oedipus being the most famous), but such stories seem to be absent in Madagascar.[9] In fact, for all their everyday talk of destiny, Malagasy seem far less fatalistic than ancient Greeks. In part, this seems to be because the role of storyteller—the person whose task it is to select from the endless flow of events along the temporal continuum that I have described above and to impose a unifying narrative framework in order to define some events as beginnings and others as ends—is so often relegated to the soothsayers themselves. As a result, the calculation of destinies generally leads to the manipulations of hasina (in the form of beads, rare woods, infusions, magical incantations), a word that, in this context, might best be conceived of as the performative power of the very act of imposing that framework itself.

Technologies of the Future

So far, then, I have suggested that many of the apparently mystical terms familiar to anthropologists (e.g., mana, witchcraft, destiny) are ways of coming to terms with basic dilemmas concerning the very possibility of human knowledge— dilemmas that are in most cases just as much a problem to social theorists as they are to those we study; that our own popular notions of chance, luck, and probability are best considered as concepts of this sort; and that all of these concepts, even those such as fate and destiny that would appear to suggest that the future is predetermined, are in reality caught up in pragmatic techniques whereby people try to influence the course of worldly events. To this, I would add that in any social system one will ordinarily expect to encounter certain spe- cialized, typically arcane forms of knowledge created on this basis that are seen as critical in understanding and influencing those patterns that determine the outcome of events—including events important to the everyday lives of ordinary people—and, for that reason, become a form of popular interest and speculation as well. Finally, I would suggest that, owing to its nature, it is never entirely clear to what degree any given statement is predictive or performative: almost always there is an element of both. Certainly, this is the case in Madagascar, where just about everyone evinces at least a passing interest in astrology, rural elders almost invariably claim proficiency, and cheap ‘almanacs’ and how-to pamphlets proliferate at even the most obscure rural marketplaces.

Almost invariably, too, there are certain specialists who claim privileged, exclusive knowledge. In very hierarchical societies, elites will either try to monopolize such matters themselves (e.g., Azande princes maintain exclusive rights to officiate over the most important oracles) or attempt to forbid them as forms of impiety (both Catholic and Sunni authorities have been known to do this at one time or another). There is also a frequent, although not universal, tendency for these techniques to draw on forms of knowledge seen as foreign and exotic: the Arabic lunar calendar in Madagascar, Chinese numerology in Cuba, Babylonian zodiacs in China, and so on. (It is not the past, perhaps, but the future that really is a foreign country.)

From this perspective, it is quite easy to see that economic science has become, in contemporary North America above all, but in most of the indus- trialized world (or, perhaps better said, financialized world), exactly this sort of popular ‘technology of the future’. There are specialists who try to keep a monopoly on certain forms of arcane knowledge that allow them to predict what is to come, although in a way that, insofar as the situation becomes politi- cal, inevitably slips into performativity. At the same time, fluctuations in the financial markets, speculation on stocks, investments, and the machinations of commodities traders or central bankers, all these have become the stuff of everyday arguments over coffee or beer or around water coolers everywhere— just as they have become the veritable obsessions of certain cable watchers and denizens of Internet chat pages. There is also a tendency—quite typical of such popular technologies of the future as well—for idiosyncratic (‘crackpot’) theories to proliferate on the popular level.

At this point, we have come full circle. Insofar as statistical probability has become a matter of everyday common sense, employed even by those who have never played a game of chance, it is due to the fact that it has become inscribed in our own most popular technology of the future. Yet, as everywhere, that tech- nology is built on top of a vacuum—a fundamental and radical limit to the very possibility of human knowledge. If time is a dimension, we do not even know how large things are—we can only know how large they were, once they no lon- ger exist. These empty spaces are endlessly generative. Just about everywhere, we find them surrounded by an immense conceptual richness; but in no case is it clear that our own theoretical apparatus is particularly superior to any other.

References

Aitken, Rob. 2007. Performing Capital: Toward a Cultural Economy of Popular and Global Finance. New York: MacMillan.

Austin, John L. 1962. How to Do Things with Words. Ed. J. O. Urmson. Oxford: Clarendon Press.

. 1970. “Performative Utterances.” Pp. 233–252 in Philosophical Papers, ed. J. O. Urmson and G. J. Warnock. 2nd ed. Oxford: Oxford University Press.

Baker, Dean. 2002. The Run-Up in Housing Prices: Is It Real or Is It Another Bubble? Center for Economic and Policy, Washington, DC.

Beck, Ulrich. 1992. Risk Society: Towards a New Modernity. London: Sage.

. 1999. World Risk Society. London: Polity Press.

Caffentzis, Constantine George. 1989. Clipped Coins, Abused Words, and Civil Government: John Locke’s Philosophy of Money. New York: Autonomedia.

Callon, Michel. 1998. “Introduction: The Embeddedness of Economic Markets in Economics.” Pp. 1–57 in The Laws of the Markets, ed. Michel Callon. Oxford: Blackwell.

Dahle, Lars. 1876. “The Influence of the Arabs on the Malagasy Language: As a Test of Their Contribution to Malagasy Civilisation and Superstition.” Antananarivo Annual and Malagasy Magazine 1, no. 2: 78–91.

. 1886–1888. “Sikidy and Vintana: Half-Hours with Malagasy Diviners.” Antanana- rivo Annual and Malagasy Magazine 11–13: 218–234, 315–324, 457–467.

Délivré, Alain. 1974. L’histoire des rois d’Imerina: Interprétation d’une tradition orale. Paris: Klincksieck.

Graeber, David. 2001. Toward an Anthropological Theory of Value: The False Coin of Our Own Dreams. New York: Palgrave.

Hacking, Ian. 1975. The Emergence of Probability: A Philosophical Study of Early Ideas about Probability, Induction and Statistical Inference. Cambridge: Cambridge University Press.

. 1990. The Taming of Chance. Cambridge: Cambridge University Press.

Haring, Lee. 1982. Malagasy Tale Index. Folklore Fellows Communication, No. 231. Helsinki: Academia Scientiarum Fennica.

Hawley, Frederick B. 1893. “The Risk Theory of Profit.” Quarterly Journal of Economics 7, no. 4: 459–479.

Holm, Petter. 2003. “Which Way Is Up on Callon?” Sosiologisk Årbok 1: 125–156.

Hopkins, William S. 1933. “Profit in Economic Theory.” Review of Economic Studies 1, no. 1: 60–66.

Knight, Frank. [1921] 1957. Risk, Uncertainty, and Profit. New York: Kelley & Millman. Latour, Bruno. 1987. Science in Action: How to Follow Scientists and Engineers through Society. Cambridge, MA: Harvard University Press.

. 1988. The Pasteurization of France. Trans. Alan Sheridan and John Law. Cambridge, MA: Harvard University Press.

Leach, Edmund. 1954. Political Systems of Highland Burma. Cambridge: Cambridge Univer- sity Press.

. 1982. Social Anthropology. Oxford: Oxford University Press.

Macaulay, Baron Thomas Babington. 1886. The History of England, from the Accession of James the Second. Vol. 2. London: Longmans, Green and Co.

MacKenzie, Donald. 2004. “The Big, Bad Wolf and the Rational Market: Portfolio Insurance, the 1987 Crash and the Performativity of Economics.” Economy and Society 33, no. 3: 303–334.

MacKenzie, Donald, Fabian Muniesa, and Lucia Siu, eds. 2007. Do Economists Make Markets? On the Performativity of Economics. Princeton, NJ: Princeton University Press.

Malinowski, Bronislaw. 1922. Argonauts of the Western Pacific: An Account of Native Enter- prise and Adventure in the Archipelagoes of Melanesian New Guinea. Studies in Econom- ics and Political Science, No. 65. London: Routledge.

. 1935. Coral Gardens and Their Magic: A Study of the Methods of Tilling the Soil and of Agricultural Rites in the Trobriand Islands. London: Allen & Unwin.

. 1948. Magic, Science and Religion and Other Essays. London: Free Press. Mauss, Marcel, and Henri Hubert. 1904. “Esquisse d’une théorie générale de la magie.” L’Année Sociologique 7: 1–146.

Miller, Daniel. 2002. “Turning Callon the Right Way Up.” Economy and Society 31, no. 2: 218–233.

Molet, Louis. 1979. La conception malgache du monde, du surnaturel et de l’homme en Imerina. Vol. 1. Paris: L’Harmattan.

Reith, Gerda. 1999. The Age of Chance: Gambling in Western Culture. London: Routledge. Suskind, Ron. 2004. “Faith, Certainty and the Presidency of George W. Bush.” New York Times Magazine, 17 October.

Tambiah, Stanley. 1985. Culture, Thought and Social Action: An Anthropological Perspective. Cambridge: Cambridge University Press.

Toynbee, Arnold J. 1969. “If Alexander the Great Had Lived On.” Pp. 441–486 in Some Prob- lems in Greek History. Oxford: Oxford University Press.

Wallerstein, Immanuel. 2003. The Decline of American Power: The U.S. in a Chaotic World. New York: New Press.

[1] Neo-classical economists, of course, were faced with a similar dilemma as they began to find it increasingly difficult to justify any difference between value and price—that is, to be able to say that a stock was over- or undervalued to begin

[2] It is worthwhile to note that George W. Bush first came to office only after losing the popular vote. Essentially, he was widely viewed as being president almost entirely because the institutional structure, from the Supreme Court to the mass media, decided to say that he

[3] Most of the sound and fury surrounding ANT has centered on its exponents’ insistence that when it comes to understanding the creation of scientific theories, the material reali- ties that are brought into being—not just humans but all components, from animals and plants to technologies, microbes, and ideas—should be considered active agents. The one unique property that is granted to humans—the one that makes them ‘actors’ rather than mere ‘actants’—is their ability to enter into negotiations about the larger meaning of the network and then to act as its Latour (1987, 1988) points out that Louis Pasteur, an extraordinarily gifted politician, accomplished this with farmers, cows, hygienists, and micro-organisms, thus creating a new physical reality.

[4] Tambiah (1985) was the first to reference Austin’s (1962, 1970) concept of ‘performativ- ity’ explicitly, but it seemed such an obvious fit that it has remained part of the tradition ever

[5] When Callon speaks of money, he treats it, at least tacitly, in accord with the standard economic myth—that it is created or adopted by rational market actors as a medium of exchange or measurement of value (see, e.g., Callon 1998: 34–37). Banks, when they are mentioned, are treated as mere facilitators of such processes. This is capitalist myth in perhaps its purest

[6] Many observers tried to insist that the value of paper currency was ultimately based on something besides public credit—usually gold or See Caffentzis (1989) for a fasci- nating account of the relation of such debates to the materialist philosophies of the time.

[7] See Macauley (1886: 485). The original essay was published in the Spectator on 1 March

[8] This is similar to trying to push the notion of fate too far into the It is possible to say that the earth is fated to be destroyed when the sun explodes in several billion years, but there is not much point in making the observation.

[9] At least, a quick survey of Lee Haring’s Malagasy Tale Index (1982) does not reveal any such